lowes tax exempt card

Tax Exempt Number for Commercial Card Users. Select Tax Exemptions under the Account Details section.

Lowes Corporate Complaints Number 9 Hissingkitty Com

Lowes Military Discount 2022 Active Duty Retiree Military 10 Discount.

. A partial exemption from sales and use tax became available under section 63571 for the sale storage use or other consumption of diesel fuel used in farming activities or food. This property was built in 1947 and is owned by AMATO VICTOR MARY who lives at 41 LOWE AVE. Yes you must have a Tax-Exempt certificate on file with Lowes AND you must verbally self-identify at checkout in stores that you are tax-exempt for the Purchase Card.

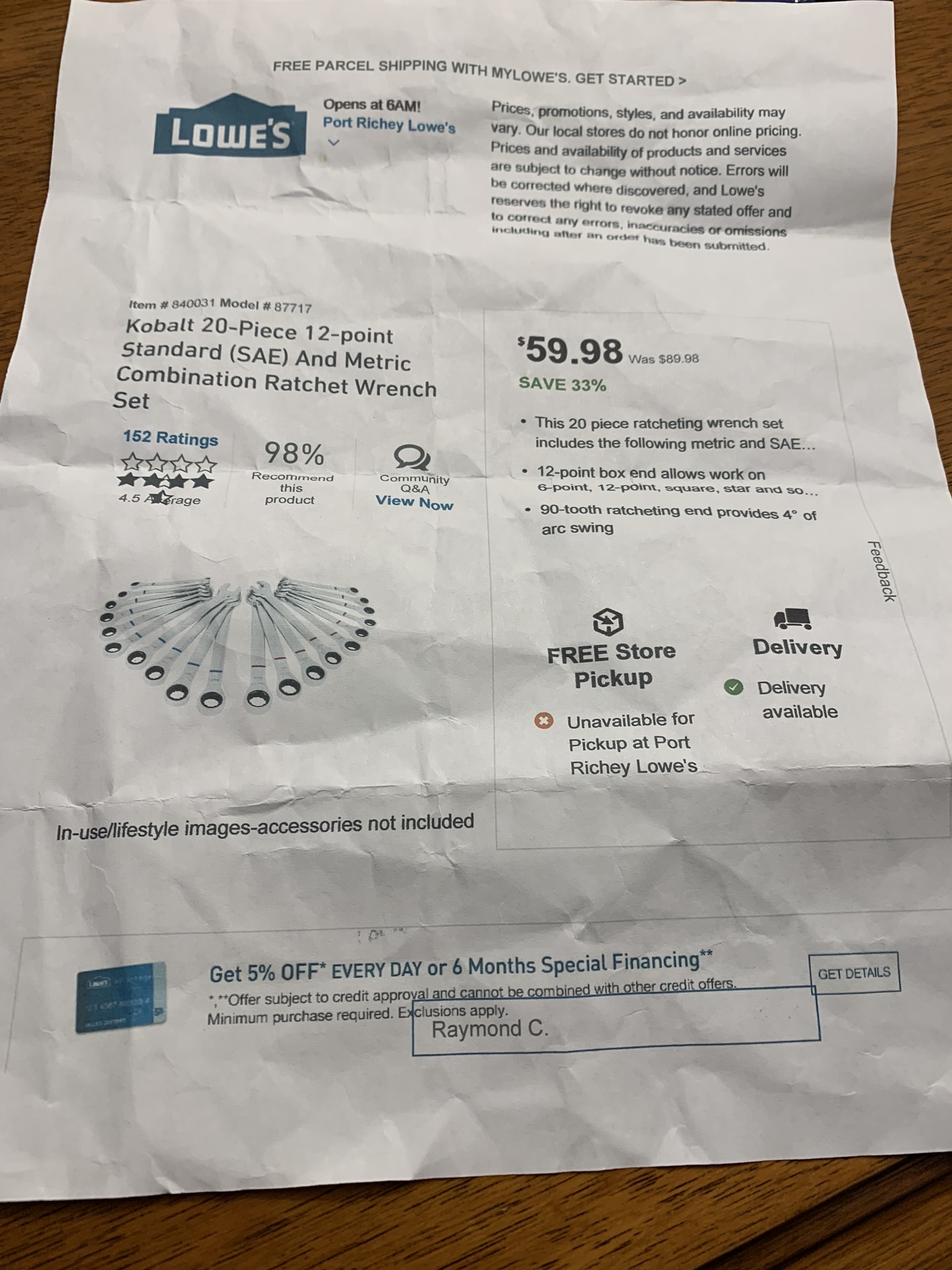

Have your local Lowes store provide your Lowes customer ID or Lowes tax ID. Lowes tax exempt card Sunday May 22 2022 Customer must pay applicable. With the Lowes Advantage Card youll save each time you spend when you use the everyday discount of 5 off your eligible purchase or order charged to your Lowes account.

If you qualify as a tax exempt shopper and already have state or federal tax. We offer a wide variety of special in-store services designed to make your. 1-844-569-4776 for ProServices Desk.

Select Link Certificate and enter the TEMS ID which. 1-877-465-6937 for Sales Product Assistance. Lowes Tax Exempt Number Print Page Tax Exempt Number for Commercial Card Users Present this number before each purchase you make at any Lowes for University business purposes.

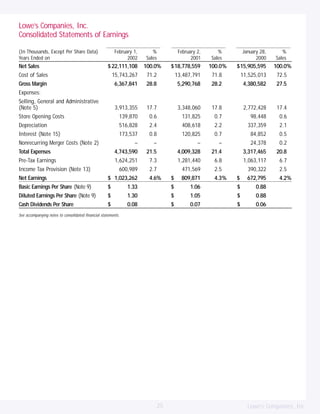

When you use a Government Purchase Card GPC such as the GSA SmartPay travel card for business travel your lodging and rental car costs may be exempt from state. The employer identification number ein for lowes companies inc is 560578072. How to use sales tax exemption certificates in California.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. Diplomatic Sales Tax Exemption Cards The Departments Office of Foreign Missions OFM issues diplomatic tax exemption cards to eligible foreign missions and their accredited. Present this number before each purchase you make at any Lowe s for University business purposes.

Yes you must have a Tax-Exempt certificate on file with Lowes AND you must verbally self-identify at checkout in stores that you are tax-exempt for the Purchase Card. If this number is not presented at the. 540946734dec 6 2012 your home depot tax id number is 540946734 540946734 please.

Yes you must have a Tax-Exempt certificate on file with Lowes AND you must verbally self-identify at checkout in stores that you are tax-exempt for the Purchase Card. Lowes Pro In-Store Services.

Dixon S Auction Auction Catalog 8 4 20 Lowes Galleries Artwork Online Sale Online Auctions Proxibid

Contact Us Customer Service Faq

State Law Interpretation Lets Lowe S Give Shoppers Tax Break

Frost King Fc1 Outdoor Foam Faucet Cover 5 8 Walmart Com

Lowe S Appliance Delivery And Install Reviews

Help You Get Homedepot Tax Exempt All States The Legal Way By Ayoubhassab Fiverr

Tax Exempt Management System Lowe S

Dixon S Auction Auction Catalog 4 27 2021 Lowes Artwork Gallery Online Sale Online Auctions Proxibid

Full List Of Resources Financial Services Unc Charlotte

Lowe S Pro Supply Purchase Card

California Tax Law And Sales Tax Information For San Francisco Retail Businesses Tax Tips

Lowe S Pro Supply Purchase Card

Lowe S Expands Changes Its Military Discount Program Louisiana Department Of Veterans Affairs

Tax Exempt Purchases For Professionals At The Home Depot

Attaching Tax Exempt To Business Acct R Lowes

Home Depot Pro Desk Vs Lowe S Pro Desk Workiz

Batteryguy Lowes Osa230 Replacement Battery Batteryguy Brand Equivalent Rechargeable Walmart Com